Global sales of smartphones to end users returned to growth in the first quarter of 2018 with a 1.3 percent increase over the same period in 2017, according to Gartner.

The report noted that there were 384 million smartphones sold in the Q1 2018 – which represents 84 per cent of all phones sold globally.

“Demand for premium and high-end smartphones continued to suffer due to marginal incremental benefits during upgrade,” said Anshul Gupta, research director at Gartner. “Demand for entry-level smartphones (sub-$100) and low midtier smartphones (sub-$150) improved due to better-quality models.”

Samsung, the world’s most popular brand, is up against strong competition from Chinese brands like Huawei and Oppo which led to the South Korean company’s slight sales slump despite the strong launch of the Galaxy S9 and Galaxy 9+ and healthy Note8 sales.

According to Gartner, Samsung smartphone growth rate will remain under pressure through 2018, with Chinese brand’s growing dominance and expansion into Europe and Latin America markets. Samsung is challenged to raise the average selling price (ASP) of its smartphones, while facing increasing competition from Chinese brands that are taking more market share.

The delayed sales boost for Apple from last quarter materialised. Apple’s smartphone unit sales returned to growth in the first quarter of 2018, with an increase of four percent year on year.

“Even though demand for Apple’s iPhone X exceeded that of iPhone 8 and iPhone 8 Plus, the vendor struggled to drive significant smartphone replacements, which led to slower-than-expected growth in the first quarter of 2018,” said Gupta.

“With its exclusive focus on premium smartphones, Apple needs to significantly raise the overall experience of its next-generation iPhones to trigger replacements and lead to solid growth in the near future.”

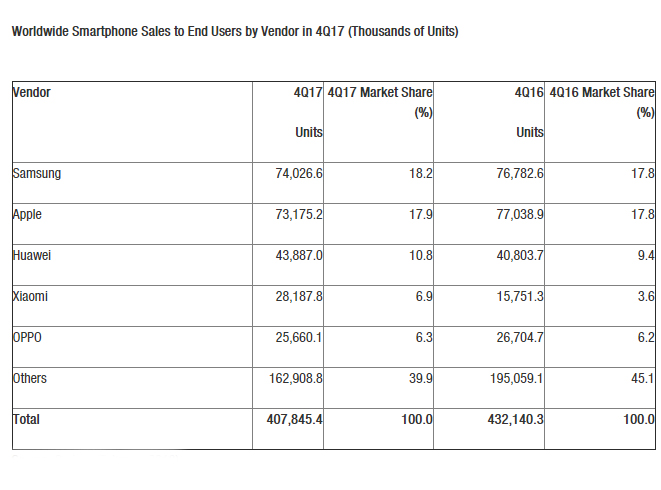

Huawei consolidated its No 3 global position with its refreshed Mate smartphones in the final quarter of 2017.

“Achieving 18.3 percent growth in the first quarter of 2018 helped Huawei close the gap with Apple,” said Gupta.

“However, its future growth increasingly depends on the vendor ramping up share in Emerging Asia/Pacific and resolving issues in the US market, through the development of a stronger consumer brand. Huawei’s attempt to grow its premium smartphone portfolio with its recent launches of the P20, P20 Pro and Honor 10 helps raise its competitiveness and growth potential.”

Xiaomi was the clear winner of the first quarter, achieving a growth of 124 percent year on year. Xiaomi’s refreshed portfolio of smartphones and aggressive pricing strategy helped it hold the No. 4 spot in the first quarter of 2018.