Lenovo Group has agreed to buy IBM’s x86 server hardware business and related maintenance services for US$2.3 billion, it announced Thursday.

Lenovo Group has agreed to buy IBM’s x86 server hardware business and related maintenance services for US$2.3 billion, it announced Thursday.

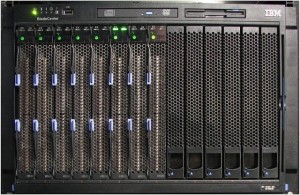

The deal encompasses IBM’s System x, BladeCenter and Flex System blade servers and switches, x86-based Flex integrated systems, NeXtScale and iDataPlex servers and associated software, blade networking and maintenance operations.

IBM will retain its System z mainframes, Power Systems, Storage Systems, Power-based Flex servers, and PureApplication and PureData appliances.

Lenovo will pay $2.07 billion in cash for the IBM business unit, topping up its offer with shares.

Although it is ranked as the world’s largest PC vendor, Lenovo has seen demand for PCs shrink and has begun diversifying, developing smartphones, tablets and smart TVs to maintain revenue and earnings. Acquiring IBM’s low-end server business will give Lenovo a new foothold in the enterprise hardware market, putting the Chinese PC maker in tighter competition with rivals Dell and Hewlett-Packard.

In its home market of China, Lenovo has also found some success in selling servers. In 2012, the company partnered with EMC to sell servers and storage there.

However, Lenovo has struggled to gain a footing in the international server market, said Rajnish Arora, Analyst, IDC.

“The server business is not just about producing hardware at the lowest price point and selling it,” Arora said. “You need to have a very robust ecosystem of solutions and partners that you can work with to drive the business.”

Unlike its competitors, Lenovo has yet to establish strong ties with software makers such as Microsoft, Oracle or VMware to create an ecosystem around its servers, he said. Currently, HP, IBM and Dell lead the market, together accounting for over two-thirds of all server sales.

Lenovo’s planned acquisition from IBM, however, will give the company added credibility among enterprise customers, according to analysts. In addition, selling servers is a higher-margin business than consumer gadgets.

Due to its PC business, Lenovo possesses the manufacturing capability and the sales channels needed to sell servers, Arora said. But to compete with its rivals, Lenovo will have do more than just sell hardware, instead building solutions tailored for its enterprise customers.

“As long as they can think differently, I think they will become formidable competition in the server space,” he said.

If the deal goes through, Lenovo’s planned acquisition will end up becoming the second time its bought a hardware business from IBM. In 2005, the company purchased IBM’s ThinkPad division, which helped Lenovo expand in the business PC market.