Advanced Micro Devices will start shipping its first ARM server chips to manufacturers for testing in the first quarter of 2014, a company executive said on Tuesday.

“When our ARM chips start sampling, [the servers] will be [among] the first few 64-bit machines out there,” said Lisa Su, senior vice president and general manager of Global Business Units at AMD.

AMD announced in June its first 64-bit ARM chips, code-named Seattle, which will have up to 16 CPU cores. The chips are expected to be available in servers during the second half of next year.

ARM processors are used in most smartphones and tablets, and are being tested in servers as an alternative to the widely used x86 chips. Some believe that servers with ARM processors will be more power-efficient at processing Web applications, which would help cut electric bills. AMD says its 64-bit ARM server chips will be up to four times faster and more power-efficient than its latest quad-core x86 Opteron X-series chips, which draw up to 11 watts of power.

AMD will sell the 64-bit ARM processors alongside x86 server processors, but the company expects ARM to outsell x86 in the long run. In 2011, ARM announced the first 64-bit ARMv8 CPU architecture, and AMD will be one of the first to ship server chips based on that technology. Most of the current ARM chips are just 32-bit, while x86 server chips from Intel and AMD have a head start with 64-bit support.

AMD is being patient with ARM. Adoption of the new architecture will take time as it will require a change in the way servers are built and software is written, Su said.

“Our thought process is it’s a multiyear effort for the market to grow. But it’s important to get the software development on it,” Su said. “We definitely view it as a long-term investment.”

There is a lot of interest in ARM chips, especially for dense servers, Su said. AMD last year bought SeaMicro, which offers dense servers packed with low-power x86 chips that can scale up performance depending on the workload.

AMD is also looking to expand into new markets with its custom-chip business, which builds device-specific hardware for customers. AMD has said the custom-chip business could deliver as much as 20 percent of the company’s revenue by the fourth quarter, which closes in December, and more than half the revenue in the coming years.

The custom-chip business is already showing results, with Sony and Microsoft using AMD’s CPU and GPU technology for their upcoming gaming consoles. The company is also targeting the living room through set-top boxes and other devices that process high-definition video and deliver content from the cloud.

“As we look forward, there are a number of areas where the same model can work. They are in the area of specialty tablets, living room as we look through how the living room evolves, and specialty server applications,” Su said.

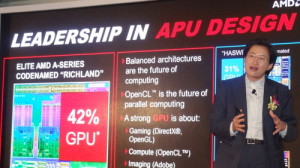

But AMD isn’t losing sight of the PC market, which continues to be its main revenue driver. The PC market has collapsed as tablet and smartphone adoption grows, but the lines are blurring between hybrids, tablets and laptops, Su said.

The company’s latest Temash chips and Kabini chips are making their way to Windows tablets and laptops starting at US$399.

“We continue to believe Windows is very important. It’s very capable. Windows 8 is something we are committed to, but we also believe Android is important as well,” Su said.

AMD has virtually no market share in tablets, and Su acknowledged that the tablet chip is a work in progress. She also pointed out there’s potential to grow in the server and custom-chip markets. After years of losses, the return to profitability in the second quarter was a key step ahead, and the company now has a sustainable business model.

“It’s very important for us to continue to execute,” Su said.