Advanced Micro Devices has announced it will sell ARM-based server processors in 2014, ending its exclusive commitment to the x86 architecture and adding a new dimension to its decades-old battle with Intel.

AMD will license a 64-bit processor design from ARM and combine it with the Freedom Fabric interconnect technology it acquired when it bought SeaMicro earlier this year, AMD said Monday.

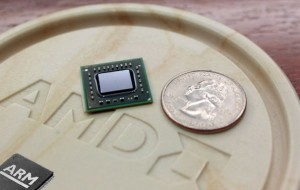

The result will be a new line of system-on-chip Opteron processors that AMD said will be ideal for the type of massive, web-scale workloads running in giant data centres like those operated by Facebook and Amazon.

AMD CEO Rory Read called the announcement a “seminal moment” and compared it to AMD’s introduction of the first 64-bit x86 processors in 2003. AMD beat Intel to the punch with that move, and it hopes to gain a similar advantage by embracing ARM.

It’s not clear yet if ARM-based CPUs will be successful in servers, but one industry analyst said the move by AMD will help. “I really think this raises ARM’s server credibility, and the credibility of microservers as a segment,” said Patrick Moorhead, president of Moor Insights and Strategy.

Server chips based on the x86 architecture will continue to be the mainstay of AMD’s server business, Read said, but he thinks the ARM-based chips will open up new markets for the company. And while AMD is focused initially on servers, he didn’t rule out the possibility that it will eventually make ARM processors for client devices such as tablets as well.

AMD hopes to sell the new server chips to vendors such as Dell and Hewlett-Packard, and will also sell them in its own servers under the SeaMicro brand. Today those systems are based on x86 processors.

AMD was joined at the event by representatives from Red Hat, Dell, Facebook and (by video) Amazon, a sign of the interest ARM-based server chips are generating.

The timing of Monday’s announcement was a bit awkward, since ARM has yet to unveil the 64-bit processor design that AMD plans to license. It’s likely to be a design code-named Atlas that ARM is expected to unveil at its TechCon conference Tuesday, though neither company would confirm that Monday.

The timing was also bad because hurricane Sandy prevented ARM CEO Warren East from flying in from the UK in time to attend the event. He appeared in a video that was hastily shot in the back of a taxi at Heathrow airport, endorsing the partnership with AMD.

ARM-based servers make sense for the new computing requirements created by services such as social networks and online gaming, said Lisa Su, an AMD senior vice president and general manager. Those workloads need a processor that can efficiently handle very large volumes of small transactions.

“The data centre is being inundated with massive amounts of data and there has to be a way to do it more efficiently in a smaller space with a lower cost point,” she said.

ARM architectures are considered more energy-efficient for some workloads because they were originally designed for mobile phones and consume less power. That has attracted several vendors to the space, including Calxeda, Applied Micro and Marvell, all of whom are developing ARM-based chips for servers.

AMD hopes to distinguish itself with two SeaMicro technologies — a custom chip that integrates many components from a traditional server board onto one chip, allowing for dense server designs; and its Freedom Fabric, which can connect thousands of servers in a cluster with low latency and at relatively low cost.

“The fabric technology is the secret sauce; this is what will make AMD’s server solution different from other vendors,” Su said.

Intel has said it won’t make ARM-based processors, in part because it doesn’t want to pay ARM a royalty on each chip. But it has been working hard to reduce the power consumption of its own server chips and said it is confident of its technology roadmap.

The company is due to release a low-power server chip in the second half of the year code-named Centerton, and will follow that up next year with a part dubbed Avoton.

“We have what is required by customers — low powered CPUs, support for key server features, and software compatibility to allow use of current workloads and not force any migration,” Intel spokesman Radek Walczyk said via email.

That still doesn’t give it an equivalent to AMD’s Freedom Fabric, however.

“Think of the chip as half the battle,” said Moorhead, the industry analyst. “The part of the battle [Intel] hasn’t discussed yet is the fabric that makes hundreds or thousands of these parts talk to each other. That’s the magic that guys like Calxeda and AMD are bringing to the table.”