Supported by Reseller Middle East, Enabler One has released the results of the first-ever vendor agnostic survey in the Middle East and North Africa region – Channel Speak. With inputs from an extensive database of partners, the survey explores key issues and paints a true picture of the regional channel business. Find excerpts of the results below:

Supported by Reseller Middle East, Enabler One has released the results of the first-ever vendor agnostic survey in the Middle East and North Africa region – Channel Speak. With inputs from an extensive database of partners, the survey explores key issues and paints a true picture of the regional channel business. Find excerpts of the results below:

Channel partners act as the extended sales arm of the distributors and vendors. However, they are often perceived as mere fulfilment routes within the IT ecosystem. Both distributors and vendors often conduct channel satisfaction surveys, which certainly provide a good view of the satisfaction levels of partners on variety of areas with their distributors and vendors. However, there is a clear market need to deeply analyse the actual challenges faced by partners and then work towards building a strategy to address those issues.

Most distributors and vendors rely on a small set of partners for over 80 percent of their business; this isn’t because of the incapability of the remaining partners, but it is rather due to the lack of the support from distributors and vendors to the remaining partners. If distributors and vendors desire to develop a much stronger partner ecosystem, then it is pivotal to expand their vision beyond their top partners.

In order to capture the ground reality of the market; and understand the true challenges and expectations of channel partners; Enabler ONE conducted the region’s first vendor and technology agnostic channel ecosystem survey, Channel Speak.

Methodology

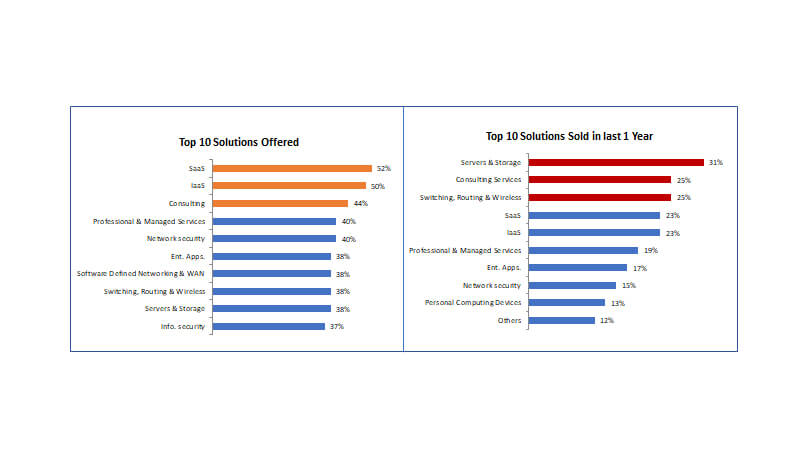

Channel Speak surveyed large and medium sized channel partners in the GCC. The overall questionnaire was broken down into four key sections, i.e. portfolio of solutions offered and sold, partner’s views on the buying behaviour of enterprises, market challenges and counter strategies adopted by partners, and the overall engagement between the IT ecosystem. This article presents the key findings of the survey, which not only are eye opening, but also thought-provoking.

| KEY FINDINGS | |

| 50%+ partners offer cloud, consulting, professional services (PS) and managed services (MS); but majority confirmed server, storage, and network infrastructure as their top sale in the last one year. | Over 30% of the respondents from top management believe they will sell consulting, SaaS, and IoT, while over the same percentage of respondents from the rest of the team of partners believe they will sell infrastructure products, cloud, applications, PS and MS in the next one year. |

| Market readiness | Are they selling OPEX deals? |

| 81% of partners confirmed that enterprises are open to take the risk of adopting new and disruptive technologies (even if they aren’t proven yet) as long as there is a clear business value. | 56% of the partners confirmed to have sold deals in OPEX model in the past one year. Breaking this down further, only 32% of the respondents from the core sales team confirmed this, in comparison to the 68% of the top management stating the same. |

| Lack of credit: Really? | Countering Challenges |

| Over 38% of the partners cited lack of credit as one of their top business challenges; yet over 60% of the OPEX deals were internally financed. | 44% partners cited new vendor partnerships, 30% confirmed geo expansion, and 42% stated services portfolio expansion as their key strategic initiative to improve business and margins. However, only 15% mentioned downsizing to improve margins. |

Despite the hype of the disruptive technologies like IoT, Blockchain, cloud, big data analytics and the like, it is quite clear that a significantly large number of channel partners at present, and in future, envision to have traditional infrastructure solutions as their top sale. Another critical area that got reflected, through Channel Speak, was the disconnect and opaqueness between the top management of partners and the actual sales teams when it came to the future vision and the existing ground reality of the market.

Channel Speak also attempted to gauge partners’ opinion on the market readiness to adopt new technologies, and the results indicate that 81% of the partners confirm the market is ready in taking the risk to adopt new technologies, the obvious question to then ask is: why aren’t they selling it? This could possibly be attributed to the lack of skills and readiness, as well as the desire to capture low hanging fruits (i.e. selling what always sells – infrastructure!) of the partners itself.

If vendors and distributors need a better ecosystem where partners are prepared and capable enough to drive a sophisticated conversation around the new technologies with the CIOs, then they will have to rethink their partner programmes all over again. If we connect the dots, we will realise that the market is ready to adopt new technologies, but the partners aren’t; and the current state of the support extend by the distributors and vendors to the channel partners is one of the key constraints around that. If one is to take a deeper look at why only 32% of the respondents from the core sales team have sold OPEX deals, as compared to the 68% of the top management – the point of the lack of readiness of the sales teams in terms of their ability to drive complex OPEX deals gets reinforced.

Almost all the partners expect distributors and vendors to provide them with presales support, lead generation, marketing support, and product trainings. The easy way is to keep supporting the partners with sales and presales support; however, the difficult and long-term solution to address this challenge is to reduce this dependency and make the partners more independent.

Distributors and vendors clearly need to develop partner programmes that are more focused on upskilling their partners; otherwise, partners will continue to have a short-term vision, and won’t evolve from a box mover to a true IT services provider, which is what most of them are aspiring for.

To gather more insight on some of the above points as well as to know more on what the channel ecosystem is really saying, download a FREE copy of the inaugural 2018 Channel Speak Report from the Enabler ONE website: www.enabler.one/channelspeak2018